The India Opportunity

We believe India’s growing population and young demographic, and its efforts

to build digital, regulatory, financial and physical infrastructure over the last

decade, will pave the way for growth acceleration over the next decade.

This will have significant implications for India’s share of the global economy

and equity markets.

India is home to a disproportionate number of high-quality companies

1

yet

remains underrepresented by equity indicies. Therefore, we see a significant

opportunity for bottom-up stock picking, by owning businesses with

strong balance sheets, robust growth and improving profitability.

Key highlights

India is underrepresented by equity indices

Infrastructure for growth acceleration was built over the last decade

Broadening opportunity set for bottom-up stock picking in India

OPPORTUNITY OPTIMUM | GLOBAL OPPORTUNITY TEAM | January 2024

AUTHORS

1

India is also home to a disproportionate number of high-quality companies (>15% 3 year revenue

growth CAGR and >15% ROIC).

KRISTIAN HEUGH

Head of Global

Opportunity

ANIL AGARWAL

Director of Research

DISPLAY 1

India is under-represented

17.6% of

Global Population

7.9% of

High-quality

Companies

3.4% of

Global GDP

1.7% of

MSCI All Country

World Index

Source: Morgan Stanley Investment Management, Factset, IMF, MSCI, as of November 30,

2023. Note: 7.9% of high quality companies is calculated based on the following. Out of 7,891

global companies with above 1 billion market cap, there are 1,774 companies with above 15%

return on invested capital (ROIC) and above 15% 3-year revenue growth compound annual

growth rate (CAGR). Of those 1,774 high-quality companies, 140 are Indian companies.

MARC FOX

Chief Operating Officer

EMILY TSUI

Executive Director

Opportunity

Optimum

discusses how

and where we

are finding the

best investments

around the world.

2

THE INDIA OPPORTUNITY

OPPORTUNITY OPTIMUM | JANUARY 2024

India offers a broad opportunity

set for long-term investors

yet it is under represented by

equity indices.

As an economy, India is likely to grow

much faster than global growth, and

despite quadrupling over the last two

decades, India’s weight in the global

equity index is just 1.7%, trailing its

current 3.4% share of global GDP. India

is also home to a disproportionate

number of high-quality companies

(>15% 3 year revenue growth CAGR

and >15% ROIC).

We believe India’s growing population

and young demographic, and its efforts

to build digital, regulatory, financial and

physical infrastructure over the last

decade, will pave the way for growth

acceleration over the next decade.

This should drive India’s nominal GDP

growth, in U.S. Dollar (USD) terms

at high single digits, taking its GDP

from USD 3.5 trillion in 2022 to USD

8.1 trillion in 10 years according to

Morgan Stanley Research.

We have made multiple investments

in India since the inception of our first

strategy in 2006, across financials,

consumer and industrials. As a team, we

look for leading businesses with large

addressable markets, opportunities

to gain share and strong management

teams we can co-invest with for the

long term. We believe India offers an

attractive hunting ground to find ideas

that meet our criteria for long-term

value creation. We expect the evolution

of the Indian economy over the next

decade will support our bottom-up ideas

rather than act as headwinds, as we

have seen in other emerging markets.

There will be volatility in performance,

but we believe that well run, high-

quality businesses in India, purchased

at a discount to intrinsic value, can

outperform over the long run.

In this note we discuss how we see

the Indian economy evolving over the

next decade, the building blocks that

have been put in place to support this

growth and the broad areas where we

are finding opportunities for investment.

India spent the last decade

creating infrastructure

A decade back, India was struggling.

Post-Global Financial Crisis, India grew

quickly, but this was followed by a

sharp slowdown. Bad loans in the

banking system increased as corporates

struggled to repay loans taken to build

projects that proved to be unviable. This

created capital issues in the banking

system that lasted for almost a decade

and led to a slowdown in investment.

Cyclically, growth was also impacted

by some of the structural reforms put

in place by the government, including a

uniform value-added tax, real estate laws

regulating builders and demonetization.

India’s young population is a tailwind

for growth, but this must be enabled

by proper policies, and, in our view, the

reforms undertaken over the last few

years have set up the infrastructure

needed to sustain strong growth

over the next decade or more. We

categorize these changes in three broad

infrastructure groups:

DIGITAL INFRASTRUCTURE: India has

taken the path of setting up digital

infrastructure as a public good, which

can be used by private enterprises

to deliver services to citizens more

efficiently. This has enabled various

services, from financial system access

to government subsidies to COVID

vaccines, being delivered to even the

weakest sections of the country with

maximum efficacy. The foundation

of this infrastructure was a universal

Biometric ID system, Aadhar (Hindi for

“Foundation”), which was launched in

2009. Today, 1.3 billion Indians have

an Aadhar ID. This is used for multiple

services. For instance, in March 2023,

Aadhar was used to authenticate 2.2

billion transactions, of which ~300

million were Know Your Customer

(KYC) transactions. This lowered the

cost of opening a bank account and

enabled 500 million new accounts to

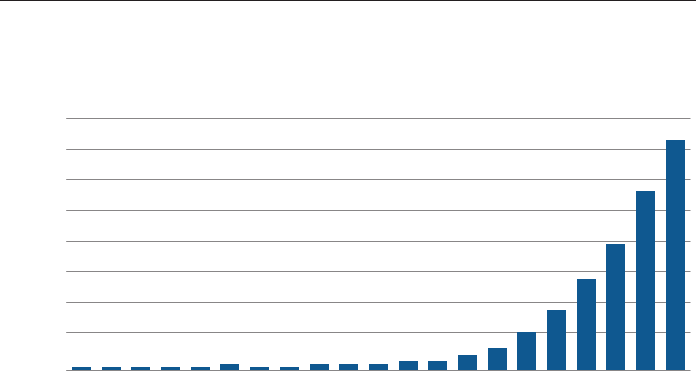

DISPLAY 2

India stands out on long term total return

Total Return CAGR, USD

Past performance is no guarantee of future results

30%

20%

10%

0%

■

MSCI EM ■ MSCI India

20 Years 25 Years10 Years5 Years1 Year

Source: Morgan Stanley Investment Management, FactSet. As of date: 31 December 2023

3

THE INDIA OPPORTUNITY

JANUARY 2024 | OPPORTUNITY OPTIMUM

be opened in the last decade, easier

and more targeted subsidies from

government among multiple benefits.

A big driver for formalization in the

economy has been the consumer

real-time payment system UPI (Unified

Payments Interface), which launched in

2016. UPI has made mobile payments

seamless and enabled the transition

from cash to digital payments.

Increased willingness of consumers to

pay through mobile has also extended

to credit cards, where payments have

grown at a 26% CAGR since 2016.

FINANCIAL INFRASTRUCTURE: A large

portion of the population had no bank

accounts until a decade ago. It was costly

to open a bank account. There was no

incentive for banks to open accounts

for economically weaker parts of the

population, leading to the exclusion

of a large part of the population from

the financial system. In 2014, the

government announced banking for all

to jump-start financial inclusion. Since

then, ~500 million new bank accounts

have opened. This was enabled by

Aadhar, as the cost of KYC dropped, and

now a vast majority of the population

has access to banking. This, coupled with

the launch of UPI, has driven rapid digital

adoption for financial services.

POLICY AND REGULATORY

INFRASTRUCTURE: Multiple steps have

been taken over the last decade to make

policies more conducive to investments.

A key move was the implementation

of the Unified Goods and Services

Tax (GST) across India. The marginal

corporate tax rate was cut to 25%, from

35%, in 2019. The monetary policy target

was moved to inflation targeting with

a 4% target (+/- 2% band) in 2016—

since then rates/currency have become

less sensitive to moves by the U.S.

Federal Reserve. The implementation

of insolvency to the bankruptcy code,

coupled with proper recapitalization

of state-owned banks, has enabled the

system to recognize bad loans.

India established a new law governing

real estate to ensure property

developers met their responsibilities in

their contracts with consumers. This

cleaned up the developer segment,

though property was a drag on the

economy for a few years. But now,

with inventory levels at historic lows

and the remaining developers having

strong balance sheets, real estate is

likely to contribute to an acceleration

in economic growth.

As an emerging market, there is a

risk of volatility in policy moves, but

these changes have made it easier for

businesses to plan for the longer term

and invest.

Growth should accelerate

compared to the last 10 years,

resulting in a broader set of

investment opportunities

India’s Prime Minister, Narendra Modi,

says the next decade could be “India’s

moment.” This could be true as the

measures taken by the country over

the last decade start contributing to

more efficient production of goods

and services. Morgan Stanley research

expects GDP per capita to increase

from USD 2,400 in 2022 to above

USD 3,600 in 10 years. Investors have

compared India to China at similar stages

of growth trajectory, but the underlying

markets, economic infrastructures and

growth drivers for the two countries

are different. We believe the relevant

economy to compare India with could be

the United States in the 1980s—given

the regulatory backdrop, consumption as

a key economic driver and large private

ownership of businesses.

The size of India’s economy is similar

to where U.S. was at the beginning of

1980. In the 80s, U.S. nominal GDP

expanded at ~7.6% CAGR and personal

consumption expenditure (PCE) grew at

~8.1%, with some of the sub-segments

even growing by more than 10% CAGR.

This drove the S&P 500 to grow 12.6%

CAGR between 1980 and 1990. India is

now at a similar stage, with similar GDP

growth potential over the next decade.

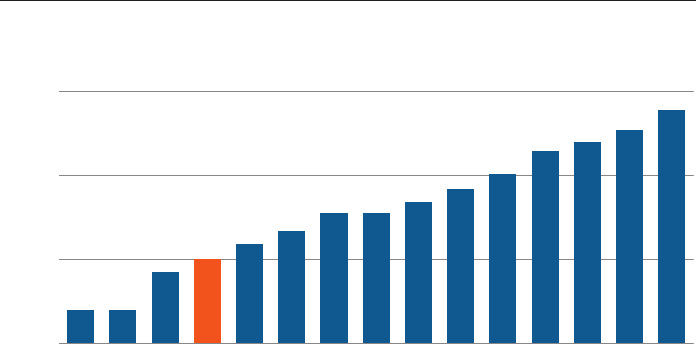

DISPLAY 3

Retail digital transactions have gone up Since UPI was launched in 2016,

helping increase formalization of the economy

80%

60%

20%

0%

F2022F2010 F2018F2016F2014F2012F2008F2006F2004

Retail Digital Transactions as % of India's GDP

10%

30%

40%

50%

70%

F2020

F1H24

1%

40%

29%

19%

12%

7%

5%

3%3%

2%2%2%

1%1%

2%

1%1%1%1%

57%

73%

Source: National Payments Corporation of India (NPCI); Reserve Bank of India (RBI);

Morgan Stanley Research. Forecasts are based on current market conditions, subject to change,

and may not necessarily come to pass.

4

THE INDIA OPPORTUNITY

OPPORTUNITY OPTIMUM | JANUARY 2024

Another factor that enhances Indian

equities attractiveness over the

long term is increased savings from

households in equities. Historically, the

Indian macroeconomy and its markets

were both dependent on global liquidity,

with the largest incremental investor

in the markets being foreign investors.

However, domestic mutual funds have

become larger and provide a more stable

and sustainable investor base. Domestic

equity assets under management (AUM)

in India is around USD 350 billion, up 10x

since 2014—their average ownership in

top 75 companies in India has increased

from 3.5% in 2014 to over 10% now, as

per Morgan Stanley Research. There

may also be stickiness in this domestic

flow into equities, with Systematic

Investment Plans (SIP)—plans for

individual investors to save a small

amount in equity funds every month—

now annualizing at close to USD 25

billion a year.

Broadening opportunity

set in India

A large proportion of Indian companies

are managed with a focus on long-term

shareholder returns. This is helped

by the fact that founders, called

“promoters” in India, own fairly large

stakes in listed companies. Promoter

ownership in the top 70 Indian

companies was 45% in September

2023, as per Morgan Stanley Research.

A large number of businesses are

focused on efficient use of capital,

given the high cost of capital in the

country, and this, coupled with the

strong economic backdrop, has driven

good market returns.

FINANCIAL BUSINESSES OFFER AN

ATTRACTIVE WAY TO INVEST IN THE

STRONG ECONOMIC GROWTH

Retail credit penetration in India has

increased over last few years but

remains low at 40% of GDP, compared

to the global average. This will likely

increase over the next decade as

consumption behavior changes and

digitization helps with efficient credit

delivery. There will be cycles, but

over the next decade, we expect

retail lending and Small and Medium

Enterprise (SME) in all forms to grow

at a CAGR in the mid-teens, driving

strong revenue growth for the system.

For more than 20 years a structural

theme for Indian banks has been the

transition of market share away from

state-owned banks to private lenders.

Given the importance of technology

in terms of offering new services, we

believe it will be difficult for state banks

to stem the continued market share

loss to private banks. This should help

better-run banks grow revenues in the

mid to high teens for multiple years.

As banks gain scale, operating leverage

will be meaningful. The combination

of a large market, significant market

share opportunity, operating leverage,

attractive valuations and governance is

tough to find globally.

INCREASING ABILITY TO SPEND

WILL HELP DRIVE PREMIUMIZATION

ACROSS SECTORS

Strong growth, a young population

and urbanization should continue to

drive consumption growth in India. The

population will also get richer, with

the proportion of households earning

over USD 8,000 a year likely increasing

from ~25% in 2021 to over 50% in

2031. Historically, a large part of the

consumer basket in India has been

concentrated in daily necessities, but

rising disposable income will change

consumption behavior to luxury, travel,

out-of-home dining, health care, beauty

and entertainment, among other

things. We believe there are well run

businesses in these segments, which

will compound in the long run:

1. LUXURY: There are growing signs

of Indian consumers spending on

luxury products. Apple opened its

first retail stores in India in 2023

and its revenues in the country

were estimated at USD 6 bn in

FY23, and Morgan Stanley research

expects this to increase to USD 40

bn in a decade. This is permeating

other segments, where consumers

DISPLAY 4

Retail credit penetration for India can increase over next decade

Retail Credit as a % of GDP

120

80

40

0

India

United

Kingdom

Germany

China

Global

United

States

Thailand

Korea

Australia

Indonesia

Brazil

Mexico

Emerging

Market s

Japan

Hong

Kong

Source: BIS Statistics Explorer, Morgan Stanley Research. As of Date: June 30, 2023.

5

THE INDIA OPPORTUNITY

JANUARY 2024 | OPPORTUNITY OPTIMUM

are premiumizing their purchases.

A key beneficiary of this trend is

likely to be the jewelry sector, given

the importance of gold for Indian

households, with India being the

second-largest importer of gold. The

sector is dominated by unorganized

players, but market share has been

shifting to organized players, a trend

accelerated by the government’s

digitization and taxation moves. As

Indians get richer, they’re likely to

consume diamond jewelry, which

would expand margins for retailers.

2. T RAV E L: More Indians are travelling

within and outside the country. The

investment in infrastructure, from

~70 cities with airports a decade

back to likely more than 200 by

2025, makes it easier for people to

travel within the country. This will

give rise to multiple businesses, from

online travel agencies to hotels. For

instance, current hotel infrastructure

is limited in India. In 2022, India had

160,000 branded rooms, compared

to 4.7 million in China, implying

significant room for growth. The

large hotel chains are focused on

profitability, adopting asset-light

strategies, driving up profitability

and becoming less exposed to

cyclical downturns.

3. FOOD DELIVERY: Food consumption

accounted for a quarter of India’s

GDP in 2019, dominated by

home-cooked food, at 90% of

consumption. Restaurant and food

delivery is underpenetrated, with

only 10% market share of the

total food market. We expect the

industry to grow steadily, driven

by socioeconomic factors including

rising urbanization, nuclearization,

more working women and higher

disposable incomes, and digitalization

will further accelerate the adoption.

4. HEALTH CARE: India’s health care

industry has grown at 12-14% CAGR

over the past five years, but it is

still underdeveloped compared

to the global market. Health care

expenditure in 2022 was around 2%

of GDP vs. the U.S. at 18%, China at

6%, the United Kingdom at 11% and

Brazil at 13%. Aside from traditional

hospital and pharmacy services, digital

health can be an interesting area given

the high smartphone penetration

rate, 75% of the population living

outside urban centers and digital

health care adoption being boosted by

the pandemic.

Indian markets have delivered strong

returns over the last two decades and

many investors, even in the emerging

markets, have missed out. We believe

the backdrop of economic growth

acceleration and more prosperous

households, will likely provide well-

run businesses the opportunity to

gain share and improve efficiencies.

This will provide numerous attractive

Indian businesses to invest in across

our team’s strategies. May all your

investing be filled with opportunity.

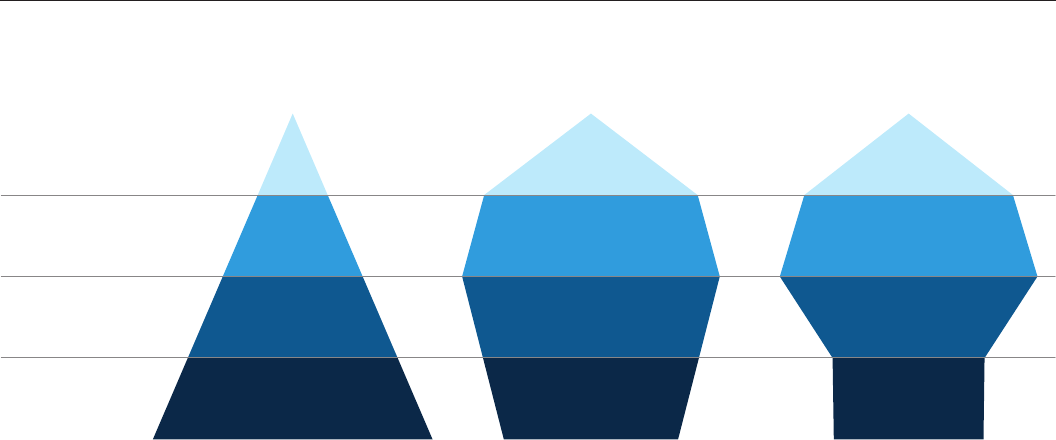

DISPLAY 5

India’s Household Income Distribution shows middle class will dominate the economy by 2030e

High

(>US$40K, Rs30L)

Upper-Mid

(>US$8K, Rs6L)

Lower-Mid

(<US$8K, Rs6L)

Low

(<US$4K, Rs3L)

Total: 219 million Total: 293 million Total: 386 million

2030F20182005

1 million

(1%)

16 million

(7%)

51 million

(23%)

151 million

(69%)

8 million

(3%)

61 million

(21%)

97 million

(33%)

127 million

(43%)

29 million

(7%)

168 million

(44%)

132 million

(33%)

57 million

(15%)

Households

e=estimated

Source: World Economic Forum, Bain, Macquarie Research, Future of Consumption in Fast-Growth Consumer Markets: INDIA, January 2019. Forecasts/

estimates are based on current market conditions and subject to change, and may not necessarily come to pass.

6

THE INDIA OPPORTUNITY

OPPORTUNITY OPTIMUM | JANUARY 2024

DEFINITIONS

Compound Annual Growth Rate (CAGR) is the year-over-year growth rate

of an investment over a specified period.

Gross Domestic Product (GDP) is the monetary value of all the finished

goods and services produced within a country’s borders in a specific time

period. It includes all private and public consumption, government outlays,

investments and net exports.

Personal Consumption Expenditures (PCE) is a measure of price changes in

consumer goods and services. Personal consumption expenditures consist of

the actual and imputed expenditures of households; the measure includes data

pertaining to durables, non-durables and services. It is essentially a measure of

goods and services targeted toward individuals and consumed by individuals.

Return On Invested Capital (ROIC) represents the rate of return a company

makes on the cash it invests in its business.

INDEX DEFINITIONS

The S&P 100 Index, a sub-set of the S&P 500, measures the performance

of large cap companies in the United States. The Index comprises 100 major,

blue chip companies across multiple industry groups. Individual stock options

are listed for each index constituent.

The MSCI All Country World Index (ACWI) is a free float-adjusted market

capitalization weighted index designed to measure the equity market

performance of developed and emerging markets. The term “free float”

represents the portion of shares outstanding that are deemed to be available

for purchase in the public equity markets by investors. The performance of

the Index is listed in U.S. dollars and assumes reinvestment of net dividends.

IMPORTANT INFORMATION

There is no guarantee that any investment strategy will work under all market

conditions, and each investor should evaluate their ability to invest for the

long-term, especially during periods of downturn in the market.

A separately managed account may not be appropriate for all investors.

Separate accounts managed according to the Strategy include a number

of securities and will not necessarily track the performance of any index.

Please consider the investment objectives, risks and fees of the Strategy

carefully before investing. A minimum asset level is required.

For important information about the investment managers, please refer

to Form ADV Part 2.

The views and opinions and/or analysis expressed are those of the author

or the investment team as of the date of preparation of this material and

are subject to change at any time without notice due to market or economic

conditions and may not necessarily come to pass. Furthermore, the views will

not be updated or otherwise revised to reflect information that subsequently

becomes available or circumstances existing, or changes occurring, after the

date of publication. The views expressed do not reflect the opinions of all

investment personnel at Morgan Stanley Investment Management (MSIM)

and its subsidiaries and affiliates (collectively “the Firm”), and may not be

reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may

not actually come to pass. Information regarding expected market returns

and market outlooks is based on the research, analysis and opinions of the

authors or the investment team. These conclusions are speculative in nature,

may not come to pass and are not intended to predict the future performance

of any specific strategy or product the Firm offers. Future results may differ

significantly depending on factors such as changes in securities or financial

markets or general economic conditions.

This material has been prepared on the basis of publicly available information,

internally developed data and other third-party sources believed to be

reliable. However, no assurances are provided regarding the reliability of such

information and the Firm has not sought to independently verify information

taken from public and third-party sources.

This material is a general communication, which is not impartial and all

information provided has been prepared solely for informational and educational

purposes and does not constitute an offer or a recommendation to buy or

sell any particular security or to adopt any specific investment strategy. The

information herein has not been based on a consideration of any individual

investor circumstances and is not investment advice, nor should it be construed

in any way as tax, accounting, legal or regulatory advice. To that end, investors

should seek independent legal and financial advice, including advice as to tax

consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past

performance is no guarantee of future results.

The indexes are unmanaged and do not include any expenses, fees or sales

charges. It is not possible to invest directly in an index. Any index referred to

herein is the intellectual property (including registered trademarks) of the

applicable licensor. Any product based on an index is in no way sponsored,

endorsed, sold or promoted by the applicable licensor and it shall not have

any liability with respect thereto.

This material is not a product of Morgan Stanley’s Research Department and

should not be regarded as a research material or a recommendation.

The Firm has not authorised financial intermediaries to use and to distribute

this material, unless such use and distribution is made in accordance with

applicable law and regulation. Additionally, financial intermediaries are required

to satisfy themselves that the information in this material is appropriate

for any person to whom they provide this material in view of that person’s

circumstances and purpose. The Firm shall not be liable for, and accepts no

liability for, the use or misuse of this material by any such financial intermediary.

Risk Considerations

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility

that the market value of securities owned by the portfolio will decline. Market values can change daily due to economic and other events

(e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments.

It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose

money investing in this strategy. Please be aware that this strategy may be subject to certain additional risks. Changes in the worldwide

economy, consumer spending, competition, demographics and consumer preferences, government regulation and economic conditions

may adversely affect global franchise companies and may negatively impact the strategy to a greater extent than if the strategy’s assets

were invested in a wider variety of companies. In general, equity securities’ values also fluctuate in response to activities specific to a

company. Investments in foreign markets entail special risks such as currency, political, economic, and market risks. Asia market entails

liquidity risk due to the small markets and low trading volume in many countries. In addition, companies in the region tend to be volatile

and there is a significant possibility of loss. Furthermore, because the strategy concentrates in a single region of the world, performance

may be more volatile than a global strategy. Stocks of small- and mid-capitalisation companies carry special risks, such as limited

product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The

risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Illiquid

securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Non-diversified portfolios often invest

in a more limited number of issuers. As such, changes in the financial condition or market value of a single issuer may cause greater

volatility. In pursuing the Portfolio’s investment objective, the Adviser has considerable leeway in deciding which investments to buy,

hold or sell on a day-to-day basis, and which trading strategies to use. The success or failure of such decisions will affect performance.

© 2024 Morgan Stanley. All rights reserved. CRC 6036330 1/31/2025 10505747_KC_1023 LTR

morganstanley.com/im

This material may be translated into other languages. Where such a translation

is made this English version remains definitive. If there are any discrepancies

between the English version and any version of this material in another

language, the English version shall prevail.

The whole or any part of this material may not be directly or indirectly

reproduced, copied, modified, used to create a derivative work, performed,

displayed, published, posted, licensed, framed, distributed or transmitted

or any of its contents disclosed to third parties without the Firm’s express

written consent. This material may not be linked to unless such hyperlink

is for personal and non-commercial use. All information contained herein

is proprietary and is protected under copyright and other applicable law.

Morgan Stanley Investment Management is the asset management division

of Morgan Stanley.

DISTRIBUTION

This material is only intended for and will only be distributed to persons

resident in jurisdictions where such distribution or availability would not

be contrary to local laws or regulations.

MSIM, the asset management division of Morgan Stanley (NYSE: MS), and

its affiliates have arrangements in place to market each other’s products and

services. Each MSIM affiliate is regulated as appropriate in the jurisdiction

it operates. MSIM’s affiliates are: Eaton Vance Management (International)

Limited, Eaton Vance Advisers International Ltd, Calvert Research and

Management, Eaton Vance Management, Parametric Portfolio Associates

LLC, and Atlanta Capital Management LLC.

This material has been issued by any one or more of the following entities:

EMEA

This material is for Professional Clients/Accredited Investors only.

In the EU, MSIM and Eaton Vance materials are issued by MSIM Fund

Management (Ireland) Limited (“FMIL”). FMIL is regulated by the Central

Bank of Ireland and is incorporated in Ireland as a private company limited

by shares with company registration number 616661 and has its registered

address at 24-26 City Quay, Dublin 2, DO2 NY19, Ireland.

Outside the EU, MSIM materials are issued by Morgan Stanley Investment

Management Limited (MSIM Ltd) is authorised and regulated by the Financial

Conduct Authority. Registered in England. Registered No. 1981121. Registered

Office: 25 Cabot Square, Canary Wharf, London E14 4QA.

In Switzerland, MSIM materials are issued by Morgan Stanley & Co. International

plc, London (Zurich Branch) Authorised and regulated by the Eidgenössische

Finanzmarktaufsicht (“FINMA”). Registered Office: Beethovenstrasse 33,

8002 Zurich, Switzerland.

Outside the US and EU, Eaton Vance materials are issued by Eaton Vance

Management (International) Limited (“EVMI”) 125 Old Broad Street, London,

EC2N 1AR, UK, which is authorised and regulated in the United Kingdom by

the Financial Conduct Authority.

Italy: MSIM FMIL (Milan Branch), (Sede Secondaria di Milano) Palazzo

Serbelloni Corso Venezia, 16 20121 Milano, Italy. The Netherlands: MSIM FMIL

(Amsterdam Branch), Rembrandt Tower, 11th Floor Amstelplein 1 1096HA,

Netherlands. France: MSIM FMIL (Paris Branch), 61 rue de Monceau 75008

Paris, France. Spain: MSIM FMIL (Madrid Branch), Calle Serrano 55, 28006,

Madrid, Spain. Germany: MSIM FMIL Frankfurt Branch, Große Gallusstraße

18, 60312 Frankfurt am Main, Germany (Gattung: Zweigniederlassung (FDI)

gem. § 53b KWG). Denmark: MSIM FMIL (Copenhagen Branch), Gorrissen

Federspiel, Axel Towers, Axeltorv2, 1609 Copenhagen V, Denmark.

MIDDLE EAST

Dubai: MSIM Ltd (Representative Office, Unit Precinct 3-7th Floor-Unit

701 and 702, Level 7, Gate Precinct Building 3, Dubai International Financial

Centre, Dubai, 506501, United Arab Emirates. Telephone: +97 (0)14 709 7158).

This document is distributed in the Dubai International Financial Centre by

Morgan Stanley Investment Management Limited (Representative Office),

an entity regulated by the Dubai Financial Services Authority (“DFSA”). It is

intended for use by professional clients and market counterparties only. This

document is not intended for distribution to retail clients, and retail clients

should not act upon the information contained in this document.

This document relates to a financial product which is not subject to any

form of regulation or approval by the DFSA. The DFSA has no responsibility

for reviewing or verifying any documents in connection with this financial

product. Accordingly, the DFSA has not approved this document or any other

associated documents nor taken any steps to verify the information set out

in this document, and has no responsibility for it. The financial product to

which this document relates may be illiquid and/or subject to restrictions on

its resale or transfer. Prospective purchasers should conduct their own due

diligence on the financial product. If you do not understand the contents of

this document, you should consult an authorised financial adviser.

U.S.

NOT FDIC INSURED | OFFER NO BANK GUARANTEE | MAY LOSE VALUE |

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY | NOT A DEPOSIT

Latin America (Brazil, Chile Colombia, Mexico, Peru, and Uruguay)

This material is for use with an institutional investor or a qualified investor

only. All information contained herein is confidential and is for the exclusive

use and review of the intended addressee, and may not be passed on to any

third party. This material is provided for informational purposes only and

does not constitute a public offering, solicitation or recommendation to

buy or sell for any product, service, security and/or strategy. A decision to

invest should only be made after reading the strategy documentation and

conducting in-depth and independent due diligence.

ASIA PACIFIC

Hong Kong: This material is disseminated by Morgan Stanley Asia Limited for use in

Hong Kong and shall only be made available to “professional investors” as defined

under the Securities and Futures Ordinance of Hong Kong (Cap 571). The contents

of this material have not been reviewed nor approved by any regulatory authority

including the Securities and Futures Commission in Hong Kong. Accordingly, save

where an exemption is available under the relevant law, this material shall not be

issued, circulated, distributed, directed at, or made available to, the public in Hong

Kong. Singapore: This material is disseminated by Morgan Stanley Investment

Management Company and should not be considered to be the subject of an

invitation for subscription or purchase, whether directly or indirectly, to the

public or any member of the public in Singapore other than (i) to an institutional

investor under section 304 of the Securities and Futures Act, Chapter 289 of

Singapore (“SFA”); (ii) to a “relevant person” (which includes an accredited investor)

pursuant to section 305 of the SFA, and such distribution is in accordance with

the conditions specified in section 305 of the SFA; or (iii) otherwise pursuant

to, and in accordance with the conditions of, any other applicable provision of

the SFA. This publication has not been reviewed by the Monetary Authority of

Singapore. Australia: This material is provided by Morgan Stanley Investment

Management (Australia) Pty Ltd ABN 22122040037, AFSL No. 314182 and its

affiliates and does not constitute an offer of interests. Morgan Stanley Investment

Management (Australia) Pty Limited arranges for MSIM affiliates to provide

financial services to Australian wholesale clients. Interests will only be offered

in circumstances under which no disclosure is required under the Corporations

Act 2001 (Cth) (the “Corporations Act”). Any offer of interests will not purport

to be an offer of interests in circumstances under which disclosure is required

under the Corporations Act and will only be made to persons who qualify as a

“wholesale client” (as defined in the Corporations Act). This material will not be

lodged with the Australian Securities and Investments Commission.

Japan

For professional investors, this material is circulated or distributed for informational

purposes only. For those who are not professional investors, this material is

provided in relation to Morgan Stanley Investment Management (Japan) Co.,

Ltd. (“MSIMJ”)’s business with respect to discretionary investment management

agreements (“IMA”) and investment advisory agreements (“IAA”). This is not for

the purpose of a recommendation or solicitation of transactions or offers any

particular financial instruments. Under an IMA, with respect to management of

assets of a client, the client prescribes basic management policies in advance

and commissions MSIMJ to make all investment decisions based on an analysis of

the value, etc. of the securities, and MSIMJ accepts such commission. The client

shall delegate to MSIMJ the authorities necessary for making investment. MSIMJ

exercises the delegated authorities based on investment decisions of MSIMJ, and

the client shall not make individual instructions. All investment profits and losses

belong to the clients; principal is not guaranteed. Please consider the investment

objectives and nature of risks before investing. As an investment advisory fee for

an IAA or an IMA, the amount of assets subject to the contract multiplied by a

certain rate (the upper limit is 2.20% per annum (including tax)) shall be incurred

in proportion to the contract period. For some strategies, a contingency fee may

be incurred in addition to the fee mentioned above. Indirect charges also may be

incurred, such as brokerage commissions for incorporated securities. Since these

charges and expenses are different depending on a contract and other factors,

MSIMJ cannot present the rates, upper limits, etc. in advance. All clients should

read the Documents Provided Prior to the Conclusion of a Contract carefully

before executing an agreement. This material is disseminated in Japan by MSIMJ,

Registered No. 410 (Director of Kanto Local Finance Bureau (Financial Instruments

Firms)), Membership: the Japan Securities Dealers Association, The Investment

Trusts Association, Japan, the Japan Investment Advisers Association and the

Type II Financial Instruments Firms Association.