1 | P a g e

TUITION WAIVER PROGRAM GUIDELINES

Updated October 2019

OVERVIEW

The Tuition Waiver Program is a generous tuition scholarship granted by the university to qualified

faculty/staff and retirees as well as their eligible dependents. In all cases, dependent children refer to

unmarried sons, daughters, stepchildren and legally adopted children of the employee or domestic

partner claimed as dependents on the most recent federal tax return. If applicable, a Domestic

Partner Certification Form must be on file with Human Resources.

The scholarship covers tuition and tuition deposits only. It does not cover books, supplies, lab fees, or

any other fees including student registration and student center fees. Refer to the Taxation of Benefits

section to determine any tax liability.

The actual amount of scholarship granted depends on an employee’s eligibility status as described

below and in the Tuition Waiver Provisions Section.

ELIGIBILITY

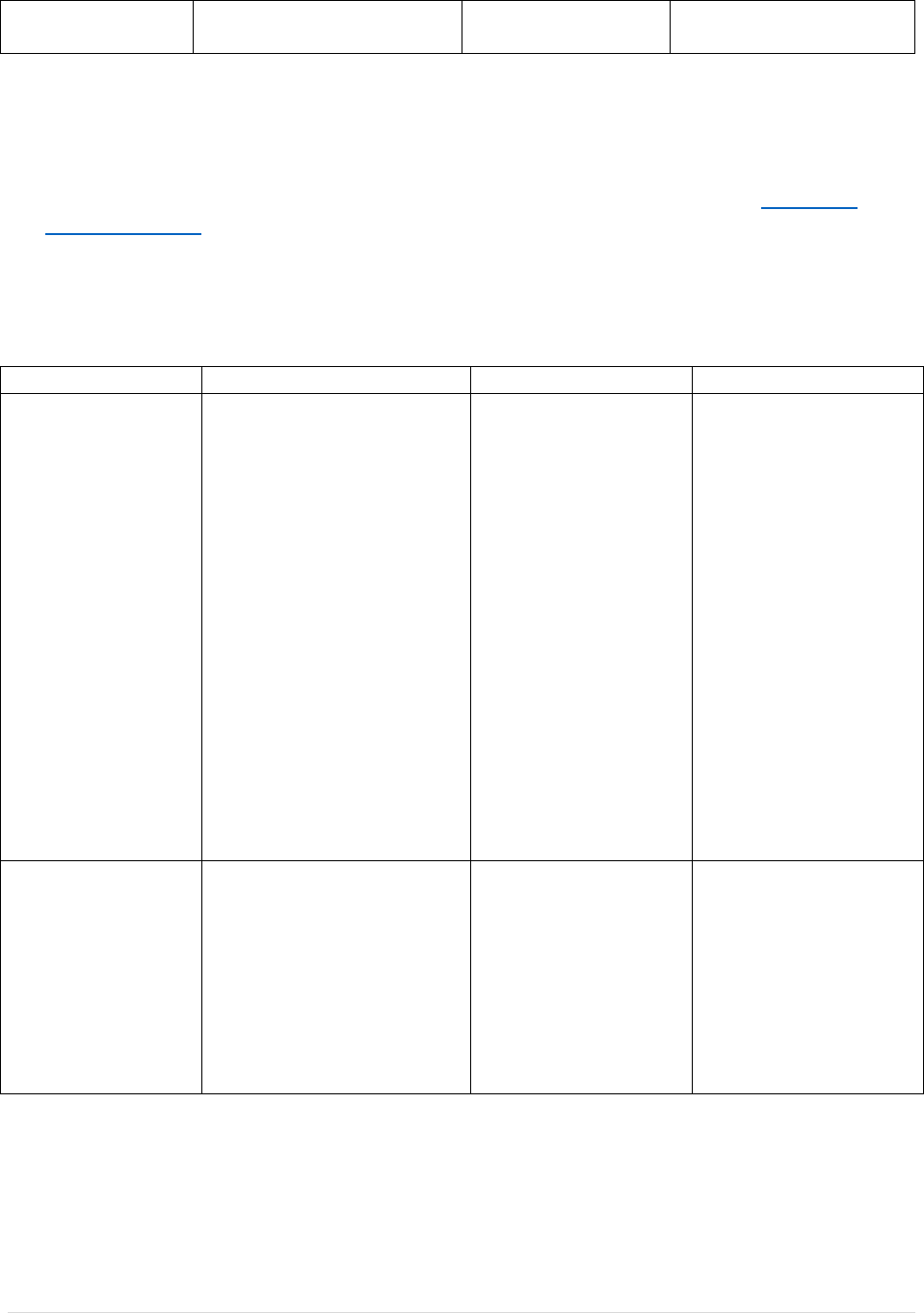

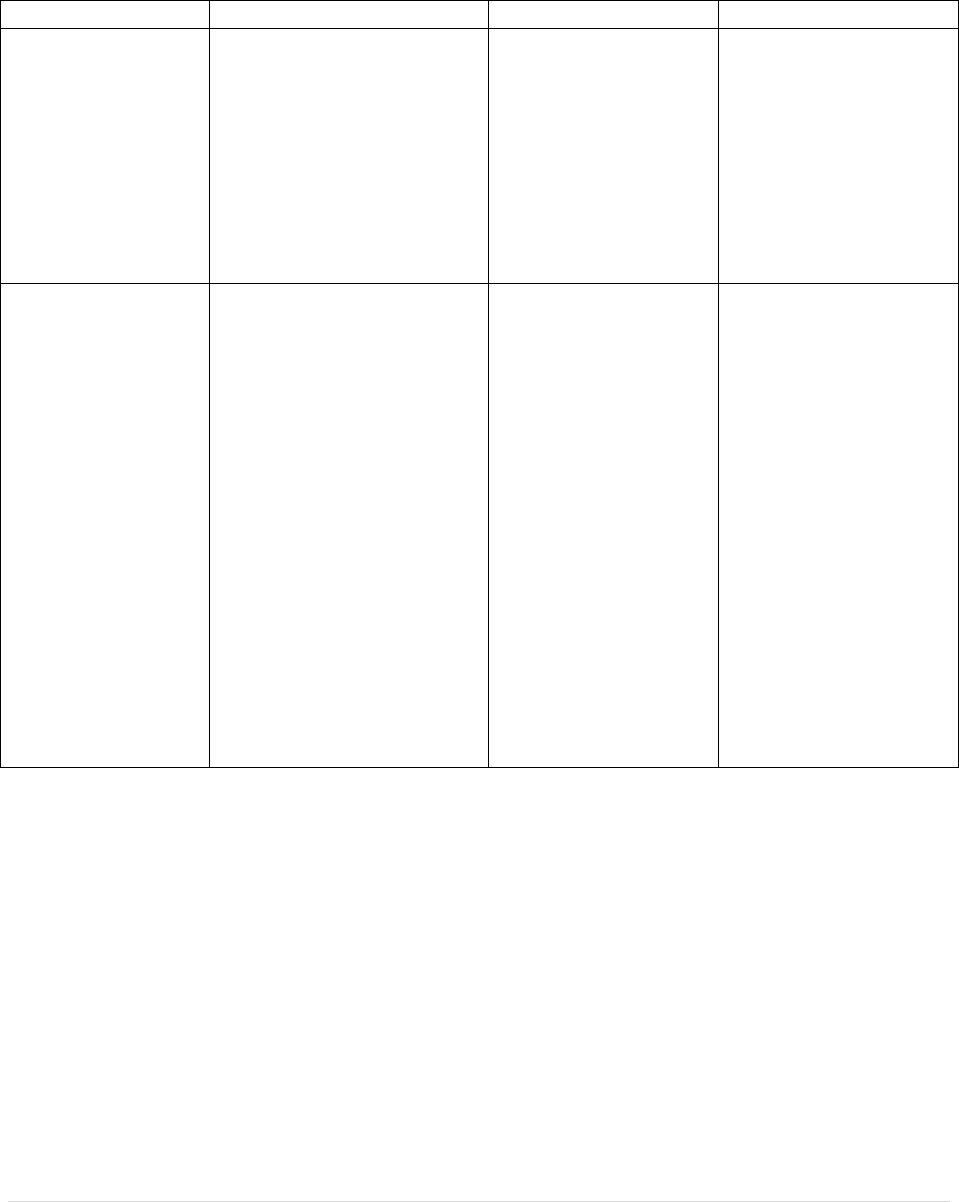

FULL-TIME FACULTY AND STAFF

Full-time staff are defined as staff who are scheduled to work at least 35 hours per week for 52 weeks.

Full-time faculty are defined as faculty who are scheduled to teach full-time for the academic year.

STUDENT STATUS

TUITION BENEFIT COVERS:

ELIGIBILITY

PROVISIONS

Full-time

Faculty/Staff

Nine credit hours per term

Begins with the term

following the date of

full-time benefits-

eligible employment.

Rehired employees do

not receive credit for

prior service when

establishing eligibility for

tuition waiver.

Spouse or Domestic

Partner

-One undergraduate or

graduate course per term

(up to a maximum of four

credit hours)

-Any credits above that will

be considered as a second

course.

-Excludes doctoral courses.

-One-half of the tuition cost

will be waived for additional

courses taken at the same

time.

-After faculty/staff

member has been

employed on a full-

time basis for three

consecutive years

-Benefits begin at the

start of the term in

which the three-year

waiting period is met.

Marriage Certificate or

Domestic Partner

Certification Form must

be on file with HRM.

Dependent

Children, which

includes children of

faculty/staff

-Full tuition for

undergraduate and

graduate courses

-Excludes doctoral courses.

Same eligibility

criteria as spouses or

domestic partners

May be enrolled in a

degree program or taking

individual courses.

2 | P a g e

members or

domestic partners

SPECIAL REQUIREMENT FOR DEPENDENTS:

− Tuition waiver forms for dependents who are full-time undergraduate students must be submitted

at the beginning of each academic year. Tuition waiver forms for dependents enrolled in the College

of Professional Studies (CPS) must be submitted at the beginning of each academic term.

− Tuition waiver forms submitted for dependent children must be accompanied by a Dependent

Certification Form each time a waiver is submitted. This form certifies that the student meets the

IRS definition of a dependent and further certifies that the student was listed as a dependent on the

employee's most recent federal tax return.

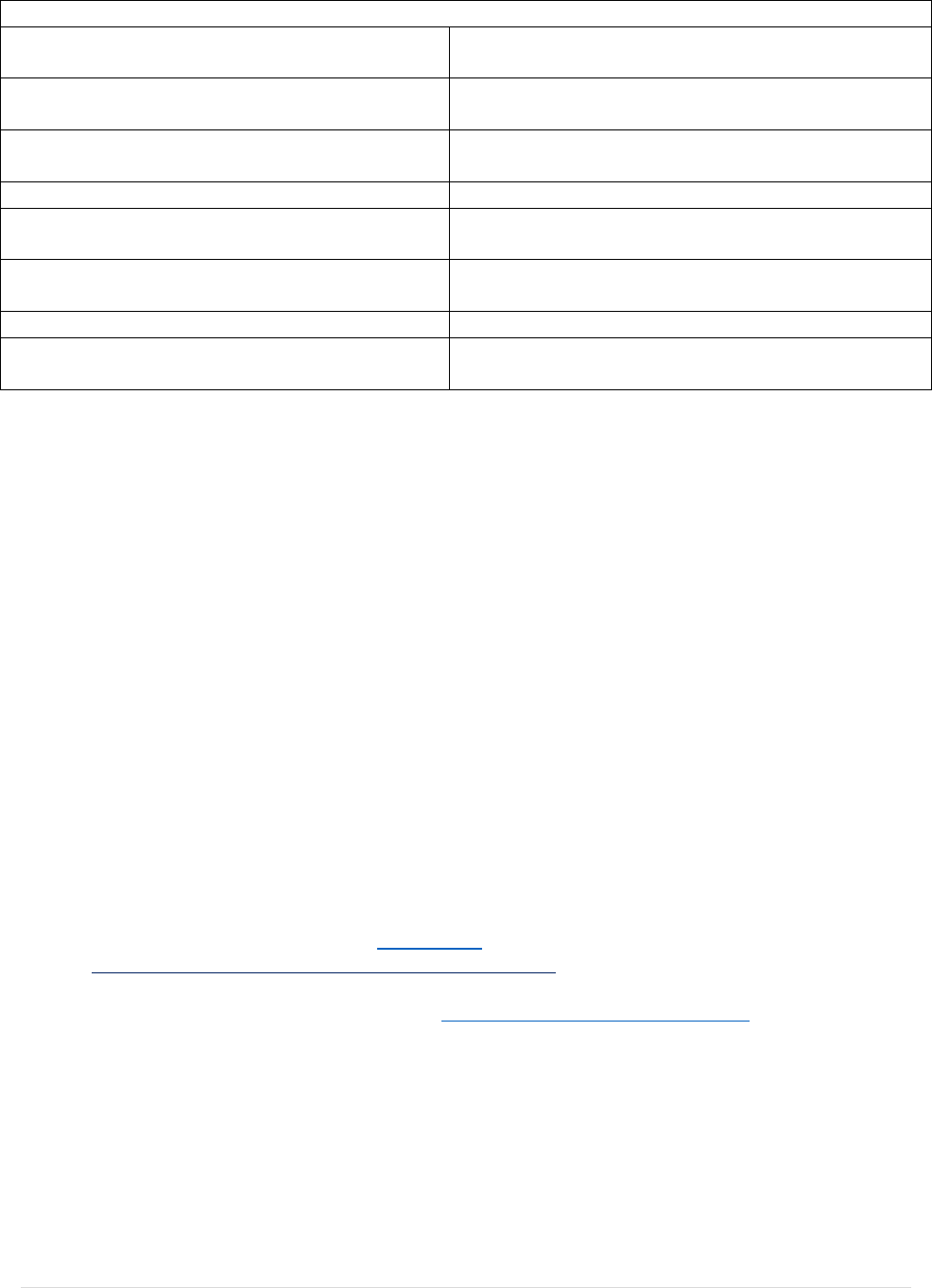

PART-TIME FACULTY

STUDENT STATUS

TUITION BENEFIT COVERS:

ELIGIBILITY

PROVISIONS

Part-time Faculty

-One undergraduate or

graduate course per term

(up to a maximum of four

credit hours)

-Any credits above that will

be considered as a second

course.

-Must have taught for

at least six terms.

-Can take the course in

the term in which

he/she is assigned to

teach after meeting

this requirement.

-If the faculty member

is not able to use this

benefit in the term in

which he/she is

eligible, it may be used

in the following term.

-If the benefit is not

used within these two

terms, the benefit may

not be carried over to

another term.

-This benefit may be

transferred to a spouse

or domestic partner.

-If the benefit is

transferred, the faculty

benefit will be

considered exhausted

in the eligible term.

Spouse or Domestic

Partner

-Benefit only applies if it is

transferred from a part-time

faculty member.

-One undergraduate or

graduate course (up to a

maximum of four credit

hours)

-Excludes doctoral courses.

Must be used in the

term in which the

faculty member

teaches.

Marriage Certificate or

Domestic Partner

Certification Form must

be on file with HRM.

3 | P a g e

Dependent Children,

which includes

children of faculty

members or

domestic partners

-If full-time student, then

one-fourth of the standard

tuition charge is waived in

the eligible term.

-If part-time student, a

maximum of four credit

hours is waived in the

eligible term.

-Excludes doctoral courses.

-Part-time faculty

member must have at

least ten years of

service.

-Benefit must be used

in a term in which the

faculty member

teaches.

May be enrolled in a

degree program or

taking individual

courses.

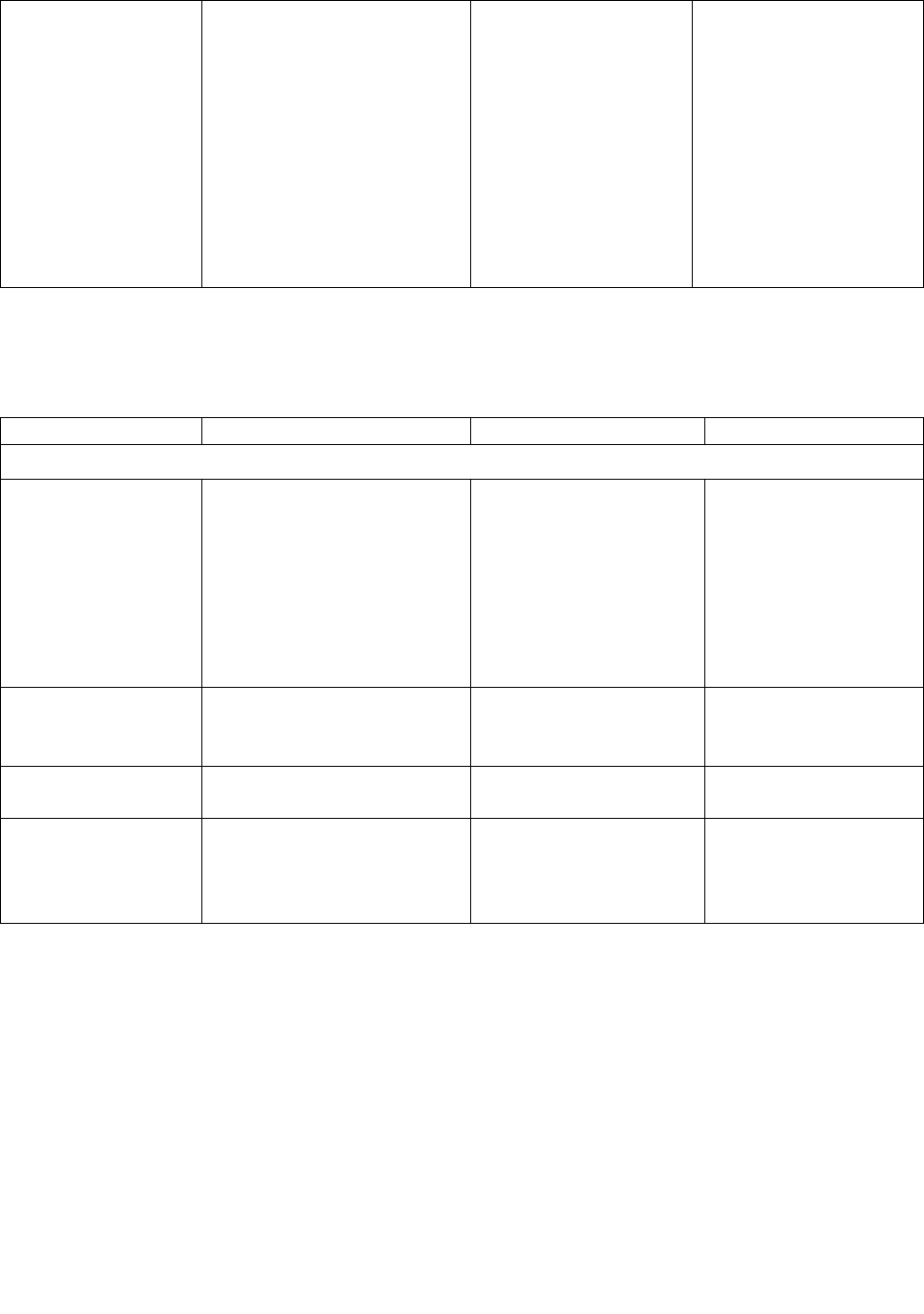

PART-TIME STAFF

Part-time staff are defined as staff who work an ongoing regular assignment and are regularly scheduled

to work a minimum of 17.5 hours per week for 52 weeks in a budgeted position.

STUDENT STATUS

TUITION BENEFIT COVERS:

ELIGIBILITY

PROVISIONS

Part-time staff with work week of:

24-34 hours per

week

Seven credit hours per

term

Begins with the term

following the date of

part-time benefits-

eligible employment.

-Courses must be

taken outside of

scheduled work hours.

-Supervisor must

provide

documentation of

established work

schedule.

17.5 to 23 hours per

week

Five credit hours per term

Begins with the term

following the date of

employment.

Same as above

Spouse or Domestic

Partner

No tuition benefit available

Dependent Children,

which includes

children of staff or

domestic partners

No tuition benefit available

4 | P a g e

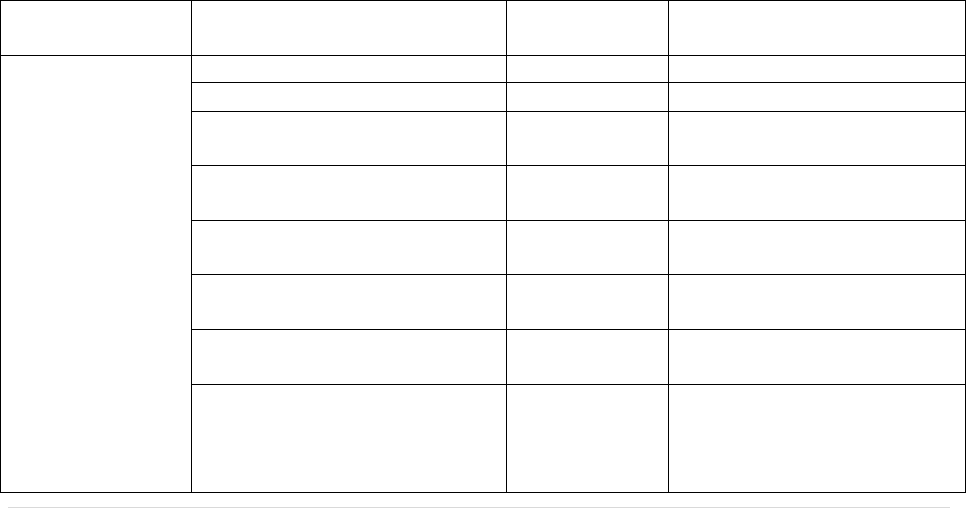

RETIRED FACULTY AND STAFF

Retired faculty/staff are defined as employees who have reached age 55, are in good standing, and have

at least 10 years of continuous benefits-eligible service immediately preceding the employee’s

retirement date. Service is considered continuous if there is less than a three-month break in service.

STUDENT STATUS

TUITION BENEFIT COVERS:

ELIGIBILITY

PROVISIONS

Retired Faculty and

Staff

-Two undergraduate or

graduate courses per term

(up to a maximum of four

credit hours per course)

-Any credits above that will

be considered as an

additional course.

See definition above.

Spouse or Domestic

Partner

-Two undergraduate or

graduate courses per term

(up to a maximum of four

credit hours per course)

-Any credits above that will

be considered as an

additional course.

-Excludes doctoral courses.

-Must be spouse or

domestic partner on file at

the time of employee’s

retirement.

-Any new spouse or

domestic partner after the

retirement date is not

eligible for the benefit.

Marriage

Certificate or

Domestic Partner

Certification Form

must be on file with

HRM.

Dependent Children,

which includes

children of

faculty/staff

members or

domestic partners

-Full tuition for

undergraduate and

graduate courses

-Excludes doctoral courses.

-Must be dependent of

employee or dependent of

domestic partner at the

time of retirement.

-Any new dependent after

the retirement date is not

eligible for the benefit.

May be enrolled in

a degree program

or taking individual

courses.

5 | P a g e

DEPENDENTS OF EMPLOYEES ON LONG-TERM DISABILITY OR OF DECEASED EMPLOYEES

The university grants scholarships to the dependent children of employees who become permanently

disabled and are no longer able to work, or die while employed by the university, provided that the

employee completed ten or more years of full-time benefits-eligible service with Northeastern

University immediately prior to the time of disability or death and under the following circumstances:

TUITION WAIVER PROVISIONS

The special provisions include:

− The scholarships are awarded with the provision that the requester is qualified for admission.

− It is the responsibility of the student to enroll or apply for admission into whichever programs or

courses he/she elects. The course registration process must be completed prior to submitting a

tuition waiver form.

− If an employee has more than one status with the university, the position with the most generous

benefit will determine the tuition benefit.

STUDENT STATUS

TUITION BENEFIT COVERS:

ELIGIBILITY

PROVISIONS

Spouse or Domestic

Partner

No tuition benefit available

If spouse or domestic

partner is currently

enrolled in a course (s),

he/she may receive the

benefit until the end of

the term in which

disability or death

occurs.

Dependent Children,

which includes

children of

faculty/staff

members or

domestic partners

-Full tuition for

undergraduate and

graduate courses

-Excludes doctoral courses.

-Must be dependent of

employee or

dependent of domestic

partner at the time of

the employee’s death

or disability.

-Any new dependent

after the date of death

or disability is not

eligible for the benefit.

-May be enrolled in a

degree program or

taking individual

courses.

-If the employee had

less than ten years of

consecutive full-time

benefits-eligible

employment at the date

of disability or death

and the dependent

child is currently

enrolled in a course (s),

he/she may receive the

benefit until the end of

the term in which death

or disability occurs.

6 | P a g e

− Terms with multiple sessions are considered one academic term for tuition waiver purposes e.g.,

summer sessions I and II are considered one academic term.

− All courses taken by Northeastern University faculty and staff must be taken outside of their regular

work hours.

−

Faculty and staff cannot use their lunchtime, vacation or sick days to attend classes.

−

One course per term may be taken one-half hour before the end of the workday. For example,

if an employee’s workday ends at 4:30 p.m., he/she may take one course that begins at 4:00

p.m. The employee's supervisor must consent in writing to this arrangement and the employee

must make up the missed work hours during each week.

− Under certain circumstances, an exception to this provision may be considered if the course is:

−

The last one needed to graduate and is not offered outside of normal work hours;

−

A prerequisite to taking additional courses needed to graduate and the course is never offered

outside of work hours; or

−

Needed to graduate and is never offered outside of normal work hours.

− The employee must provide supporting documentation to show eligibility for the above exception.

In addition, the employee’s supervisor must consent in writing to this arrangement. These

documents must be sent to HRM. HRM will make the decision on the granting of the exception as

outlined above.

− No faculty member above the rank of instructor may enter a graduate degree program in his/her

own department or comparable unit. Faculty members engaged in graduate degree programs in

their own colleges may not participate in decisions regarding graduate curriculum or related

matters, or vote on graduate degrees.

− Please refer to the Student Handbook for the procedures on how to drop a course and the

corresponding penalties. If there is a penalty, the employee must have filed a Tuition Waiver or

he/she will be billed for the course.

WHAT IS COVERED AND WHAT IS NOT COVERED?

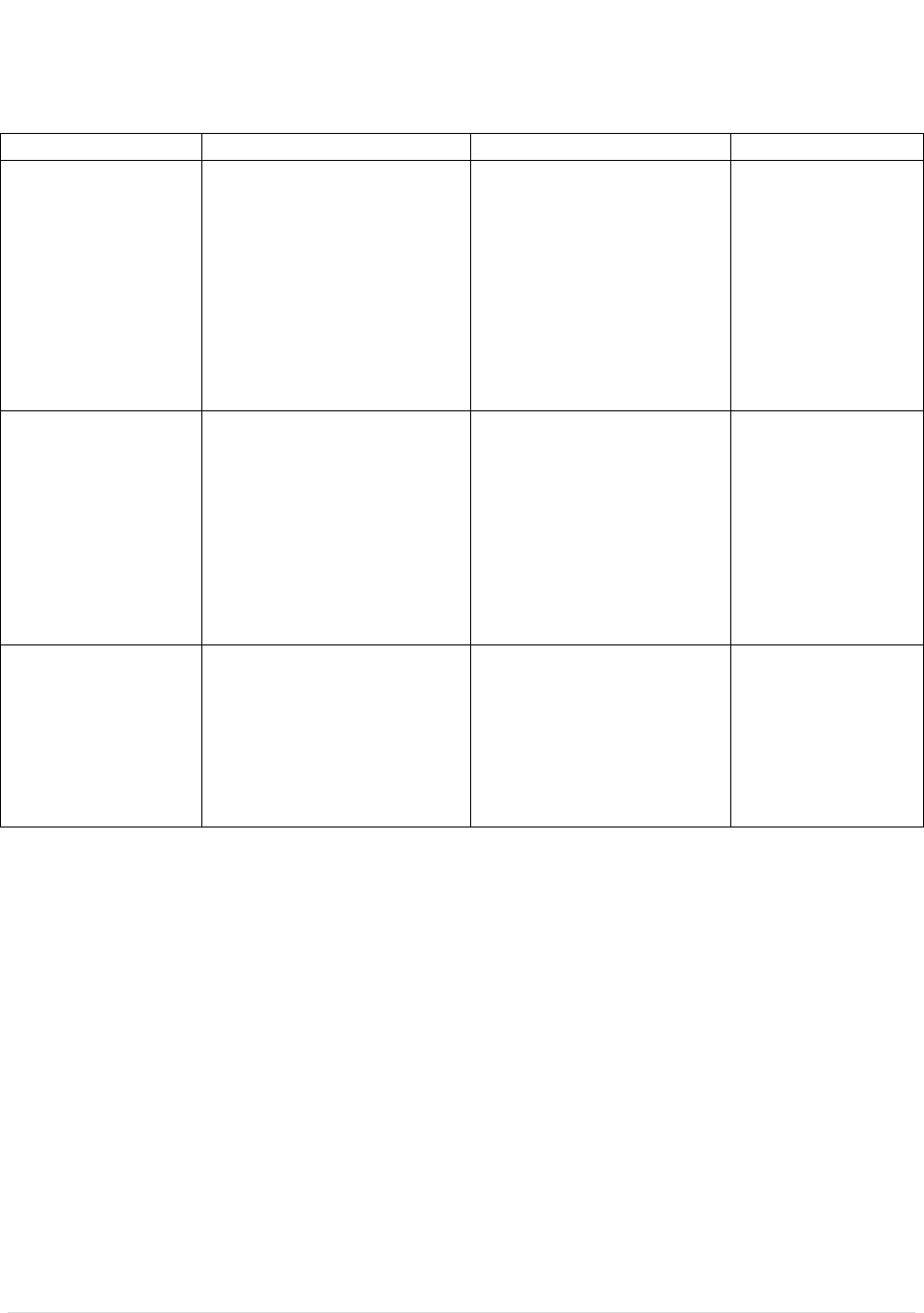

PROGRAMS NOT COVERED

PROGRAM NAME

COVERAGE

NU IN

Not Covered

Healthcare Innovation & EntrepreNURSEship

Not Covered

ABSN (Accelerated Bachelor of Science in Nursing)

Not Covered

RN to BSN

Not Covered

Global International Pathways

Not Covered

NUBound Program

Not Covered

Online MBA

Not Covered

Online MS in Finance

Not Covered

Online MS in Taxation

Not Covered

Summer Discovery Program

Not Covered

7 | P a g e

PARTIALLY COVERED PROGRAMS

Law School: JD and Master of Law (LLM) Programs

Spouse/Domestic partners & dependent children

eligible. Not extended to employees.

Faculty Led Study Abroad: Dialogues, Three Seas

Partial Coverage for dependent children. Tuition

benefit will waive one-third of tuition.

Basic International Study Abroad Programs

Partial Coverage for dependent children. Tuition

benefit will waive one-third of tuition.

Executive Doctorate in Law and Policy

Employee is eligible for 70% tuition discount.

Online Master of Law (LLM) Program

Extended to employees. Spouse/domestic partners

and dependent children not eligible.

Doctoral Programs

Extended to employees. Spouse/domestic partners

and dependent children not eligible.

IFSE- International Field Study Experience

Covers course tuition only.

Business Exchange and Graduate International

Studies

Dependent children only-covered at 100%.

HOW TO APPLY FOR TUITION REMISSION

− Full-time benefits-eligible faculty and staff can access the Tuition Waiver form online at myneu.edu.

Click on the Benefits and Services tab and then on the Tuition Waiver form.

− All other eligible employees can contact HRM at 617-373-2230 to request a copy of the form.

− Forms must be submitted to HRM to ensure adherence to the Tuition Waiver Program Guidelines.

Proper signature levels are required before HRM approves the waiver. HRM will forward a copy of

the approved waiver directly to Student Accounts.

− All waivers must be received within 30 days of the course start date. This allows HRM and Student

Accounts to provide employees with prompt notification of any problems with the waiver request.

This timing also allows the employee to withdraw from the course before the tuition charges are

incurred. Submission of late waiver requests do not allow for the proper taxation of tuition benefits

(when applicable) within the appropriate calendar year.

− Benefits-eligible faculty and staff with access to the online Tuition Waiver form can track the status

of the tuition waiver from the time it is submitted until it is processed by Student Accounts. After

the tuition waiver form has been approved by HRM, the status will be noted at Approved. After

Student Accounts has processed it, the status will be noted as Processed. Employees can also track

the status of a tuition waiver form by clicking here or logging on to:

− https://neuforms3.neu.edu/lfserver/TuitionWaiverStatusForm

− Please contact the Student Accounts team at studenta[email protected]u for account

related questions as they will have the most up-to-date information.

8 | P a g e

TAXATION OF BENEFITS

− Federal and state regulations mandate that certain tuition benefits are subject to federal and state

taxes. Some or all of the benefits received under the tuition waiver program may be considered a

taxable benefit. In general, graduate coursework and coursework for domestic partners and

dependents of domestic partners will increase the amount of taxable income for the year

− The estimated withholding is generally 37.65% of the tuition value exceeding the IRS maximum. This

tax percentage represents the sum of the following: 25% federal, 5% state and 7.65% Social

Security/Medicare taxes. This is typically true for Massachusetts residents. Please refer to current

IRS policy and applicable federal and state tax tables to identify individual tax liability.

− Affected employees will be notified by Student Accounts of the taxable tuition value and the

timeframe that payroll taxes will be withheld for the applicable academic term. If an employee

terminates or retires, the tuition benefit will extend until the end of the course. Any unpaid taxable

tuition will be included on a Form W-2 or 1099 in the appropriate calendar year.

− Graduate level courses that have NOT been approved as job-related are subject to taxation if the

tuition waiver benefit exceeds the IRS maximum (currently $5250) in a calendar year.

− An employee is responsible for discussing his/her job-related course selection(s) with his/her

supervisor prior to submitting the tuition waiver form for approval.

− The supervisor reviews the courses requested by his/her employees to ensure that they are job-

related. Job-related courses include:

−

Any course that allows the employee to meet minimum job requirements for his/her current job

as supported by his/her job description is to be considered job-related.

−

Any course that maintains or improves the skills required by the employee’s current job as

supported by his/her job description is to be considered job-related.

The following chart depicts the current taxable consequences for various course enrollees. As these

regulations are subject to change without notice; please refer to the current Internal Revenue Service

(IRS) regulations. This information is provided for general guidance only.

TYPE OF COURSE

STUDENT STATUS

TAXABLE TO

EMPLOYEE?

TAX WITHHOLDING PROCESS

UNDERGRADUATE

Faculty/Staff

No

Does not apply

Retiree

No

Does not apply

Spouse (of active or retired

employee)

No

Does not apply

Domestic Partner (of active or

retired employee)

Yes

Payroll deduction during

calendar year

Dependent children (of active or

retired employee)

No

Does not apply

Dependent children of Domestic

Partner

Yes

Payroll deduction during

calendar year

Dependent children (of LTD–

eligible or deceased employee)

No

Does not apply

Dependent children (of

Domestic Partner of LTD-

eligible, retired or deceased

employee)

Yes

Taxable value will be included

on Form W-2 or 1099, as

applicable.

9 | P a g e

GRADUATE

Faculty/Staff

Yes if not job-

related and

value exceeds

IRS max; No if

job-related

Payroll deduction during

calendar year

Retiree

Yes

Taxable value will be included

on Form W-2 or 1099, as

applicable.

Spouse (of active or retired

employee)

Yes

Payroll deduction during

calendar year or tax liability

will be included on Form W-2

or 1099, as applicable.

Domestic Partner (of active or

retired employee)

Yes

Payroll deduction during

calendar year or tax liability

will be included on Form W-2

or 1099 as applicable.

Dependent children (of active

employee)

Yes

Payroll deduction during

calendar year

Dependent children of Domestic

Partner

Yes

Payroll deduction during

calendar year

Dependent children (of LTD–

eligible, retired or deceased

employee)

Yes

Tax liability will be included on

Form W-2 or Form 1099, as

applicable

Dependent children (of

Domestic Partner of LTD-

eligible, retired or deceased

employee)

Yes

Tax liability will be included on

Form W-2 or Form 1099, as

applicable.

For an employee on a leave of absence exceeding 30 days, the tuition waiver benefit will only apply to

covered dependents. This includes the spouse, domestic partner and/or dependent children of the

employee and/or domestic partner. Refer to the taxable consequences for the spouse, domestic

partner and/or dependent children of an active employee cited above for general guidance.